Comparison of terminal indicators scoring methods between ESGB and EEWH【3】

5. Comparison of the SMTIs between ESGB and EEWH

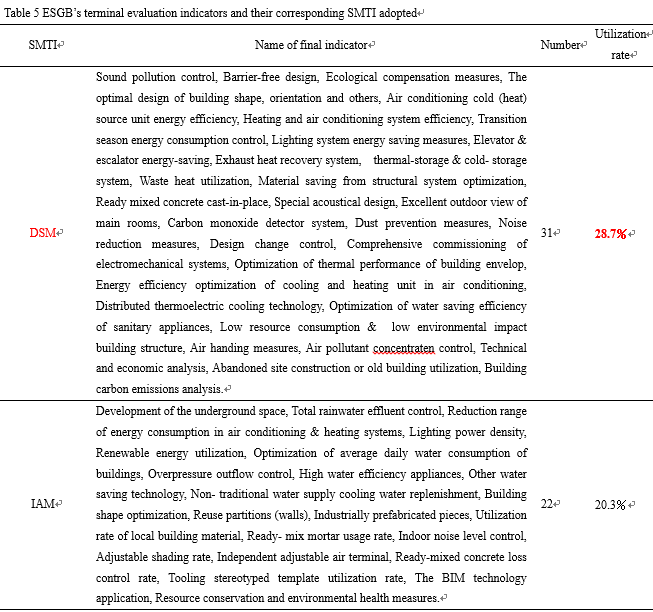

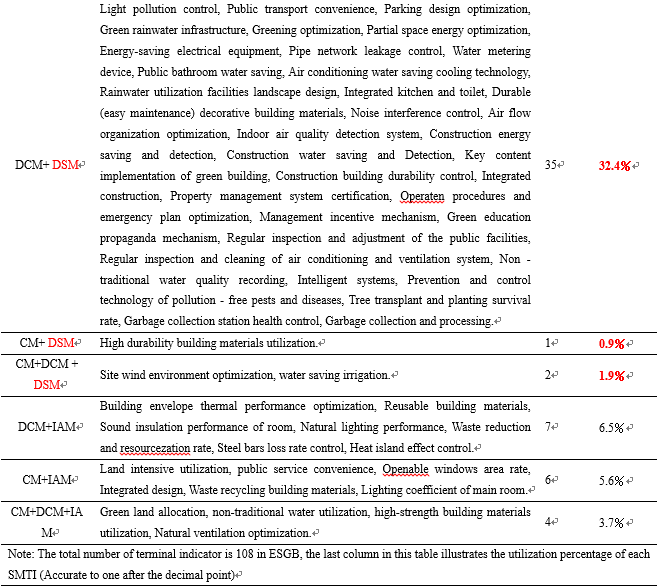

5.1 Analysis on the SMTI types utilized in ESGB and their corresponding utilization percentages

As shown in Tab. 4, ESGB has clearly illustrated its classification regulations and classified its SMTIs into five categories[7], its classification criteria, however, is relied on the superficial discrepancies relative to the classifying standards of the eight SMTIs reflected in Tab. 3. Essentially, the five SMTIs reported in ESGB[7] (Tab. 4) are four of eight SMTIs illustrated in Tab. 3 and their combinations. To be specific, those four SMTIs are DSM, IAM, CM, and DCM. Apparently, mere two independent methods – DSM and IAM -was utilized in ESGB, since CM and DCM are auxiliary methods.

Additionally, incorporating the classification criteria shown in Tab. 3, whole 108 TIs of ESGB were classified into Tab. 5. On the foundation of this work (Tab. 5), the utilization percentages of each SMTI were also calculated with the accuracy to one after the decimal point. Apparently, DSM dominated the SMTI of ESGB with just below two-thirds percentage of TIs relied on it to achieve quantitative assessment, even though several types of combination appeared on ESGB, such as DCM+DSM, CM+DSM, and CM+DCM+DSM. Moreover, the second popular SMTI in ESGB is IAM. The overwhelming dependence of ESGB’s QES on DSM may improve its operability, however, it may also lead to inaccurate evaluation result, since DSM assess indicators subjectively [20,21].

5.2 Analysis on the SMTI types utilized in EEWH and their corresponding utilization percentages

A similar process as section 5.1 was also conducted to classify the SMTIs adopted by EEWH on the basis of classification standards shown as Tab. 3. The detailed information was presented by Tab. 6, and it is notable that the diversity of SMTIs in EEWH is rich than ESGB, six SMTIs in total with five independent SMTIs were utilized in EEWH. To be specific, five independent SMTIs are FSM, IAM, DSM, ASM and MOM and the mere auxiliary SMTI is CM. Subsequently, the calculation of utilization rates of each SMTIs in EEWH was also conducted and described in Tab. 6.

Similarly, EEWH’s QES is also dominated by one SMTI, which is FSM rather than DSM in ESGB, even though the EEWH’s SMTI diversity is much rich than ESGB, especially in independent SMTIs. Interestingly, the most popular SMTI in ESGB was used un-frequently with only 12.0% utilization percentage and IAM, the second popular SMTI in ESGB, merely accounts for 9.6% in EEWH.

5.3 The comparison of utilized SMTI types and corresponding utilization rates between ESGB and EEWH

On the foundation of research outcome from section 5.1 and 5.2, the primary data from Tab 5-6 can be transformed into Tab. 7, which contains the SMTI types adopted in two GBRTs and the utilization percentage of each SMTI in corresponding GBRTs respectively. From the data comparison in Tab. 7, several conclusions can be obtained, listed as follows:

1. Regarding the utilized SMTI types in two GBRTs.

1) There is a considerable discrepancy between ESGB and EEWH in adopted SMTI types, and the EEWH’s SMTI diversity is greater than ESGB, especially related to independent SMTI. Specifically, five independent SMTIs and one auxiliary SMTI were utilized in EEWH relative to two plus two in ESGB.

2) Two independent SMTIs, embracing DSM and IAM, and an auxiliary SMTI named CM, were shared by two GBRTs. In addition, three EEWH’s independent SMTIs, including FSM, ASM, and MOM, didn’t appeared on ESGB, and an auxiliary SMTI (DCM), widely utilized in ESGB, wasn’t shown up in EEWH.

2. For the utilization percentages of each SMTI in two GBRTs.

3) Notably and interestingly, the QESs of ESGB and EEWH are similarly dominated by one SMTI. To be specific, DSM and FSM account for the major proportion in ESGB and EEWH respectively, with the same share (63.9%).

4) The dominated and second popular SMTI, DSM, and IAM, share the similar proportions with ASM in EEWH, with the percentage just above 10%.

5) MCM, including CM and DCM, plays a vital role in both ESGB and EEWH, Similar rate of TIs (about 12%) in two GBRTs are utilized CM to support its evaluation and approximately half of TIs (44.4%) in ESGB dependent on DCM to simplify its assessment process while it wasn’t utilized in EEWH.

|  |

分享让更多人看到

推荐阅读

相关新闻

- 评论

- 关注

第一时间为您推送权威资讯

第一时间为您推送权威资讯

报道全球 传播中国

报道全球 传播中国

关注人民网,传播正能量

关注人民网,传播正能量